Controlling What You Can is our new series dedicated to asking YOU what matters most on the major policy topics that face the nation. This post is a recap of a poll we put out on 5/29/2025. If you want to join the conversation, keep an eye on your inbox and check us out on X – we ask a new question every week. Want to join the conversation? Sign up here and follow us on X.

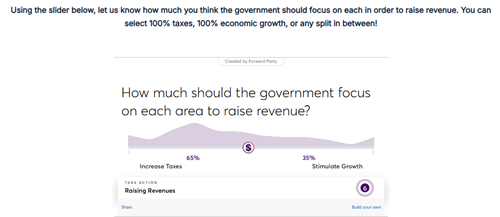

We asked you all two big questions about how we should focus revenue raising activities. The first was a general overview question of “How much should the government focus on each area to raise revenue?”

In general, Forwardists think we should focus more on raising revenue than on stimulating growth, but it’s by no means unanimous (by the way, if you want to add your thoughts to this slider, or leave a comment on the page, you can do so here).

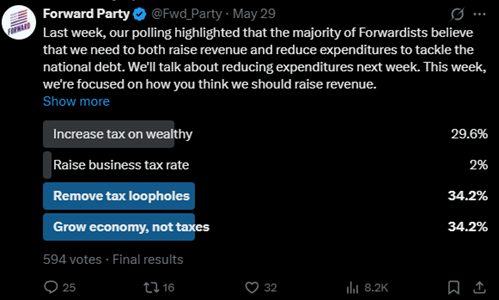

After that, we dug into more detail – we asked you what specific policy proposals we think the government should focus on to get the job done.

Diving into the results, a common theme continues to develop in how Forwardists approach problems. In short, we look to keep all reasonable options on the table to tackle problems from different angles.

Here, most respondents said that we should focus both on increasing taxes and stimulating growth, with many noting that the stimulating growth itself will increase taxes. On the slider, the vast majority wanted to focus on both raising taxes and stimulating growth, with different relative levels of focus.

Digging into the polls, we can see a pretty interesting picture develop! Raising the business tax rate was very unpopular, with many noting that this could inhibit growth and potentially lower taxes.

The other three options, however, were pretty much tied! If we read all of these data points and comments together (with some earlier comments on small business support), it paints a picture of an approach to increasing revenue. The government should stimulate growth, and that involves leaving the business tax rate alone. From a prior poll, we assume that most Forwardists would be in favor of doing so by supporting small businesses. Then, the tax code can be simplified to eliminate loopholes, and the top tax rates can be increased.

Looking at the comments, you said:

Stimulate Revenue via Growing the Economy through Targeted Government Investment

- You argued that maintaining our current business tax level (or even lowering it) would encourage business activity and higher tax revenue.

Innovative Policy Solutions

- Many of you called for a rethink of our tax system generally, with shifts ranging from support for Value-Added Taxes, automation taxes, or even a 10% universal tariff that would exclusively be spent on paying down the debt.

Higher Top Tax Brackets & Closing Loopholes

- Many of you cited the ways that our tax code is set up to allow for tax loopholes to unfairly lower taxes and noted we should focus on closing those loopholes to ensure all are paying their fair share.

- You also called for adding in more tax brackets on the high end to reflect the shifting reality of incomes in the current economy.